Q1 2024: New funding for clean hydrogen projects

Download PDF

It has long been recognised that low-carbon hydrogen will play an important role in the UK’s future energy system. It offers a route to decarbonise heavy industry, store energy between seasons, or to export excess low-carbon electricity overseas. Particularly in the UK, it is being explored for its complementary role in assisting the integration of offshore wind. The Government is targeting 10 GW of low-carbon hydrogen production by 2030, and has provided £240m of funding to the Net Zero Hydrogen Fund (NZHF). This will provide subsidies and capital investment to projects across the UK.

Almost all hydrogen is currently produced from high-carbon natural gas (referred to as “grey hydrogen”), but the addition of carbon capture and storage could reduce emissions (“blue hydrogen”). Alternatively, renewable electricity could be used to split water into hydrogen and oxygen in electrolysers (“green hydrogen”), reducing production emissions close to zero. The Government believes both green and blue hydrogen are crucial to the deep decarbonisation of power, transport and “hard to electrify” industrial processes. However, the use of hydrogen is becoming an increasingly contentious proposal, with critics highlighting the high costs, technical barriers, and recent global setbacks for hydrogen companies.

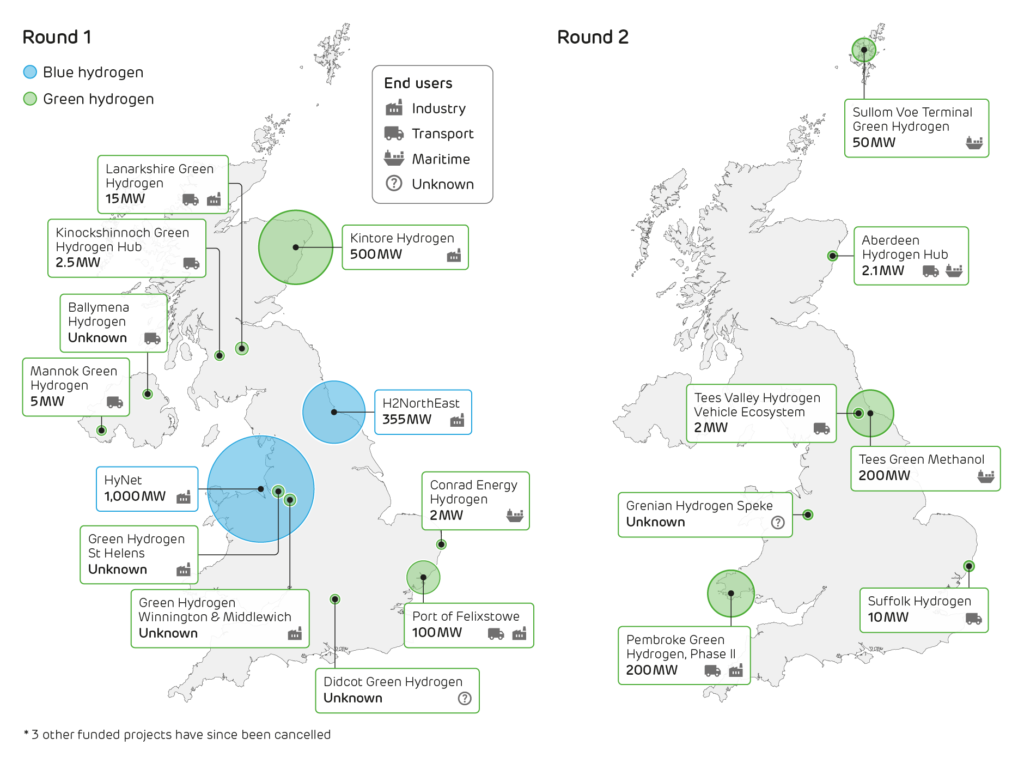

At the 2024 Hydrogen Investor Forum, the Government announced £21m of NZHF support throughout the UK. Three of the successful projects will produce clean hydrogen for industry and transport, while the other four will supply hydrogen to sectors ranging from pharmaceuticals to automotive. The seven successful projects are mapped below, alongside the fifteen projects supported through previous rounds of the NZHF.

The geographic distribution of projects supported under Round 1 and Round 2 of the Net Zero Hydrogen Fund (NZHF). Marker colour indicates the colour of hydrogen production being used, and marker size reflects the production capacity being planned.

Hydrogen will be competing against established fossil fuels and other emerging low-carbon technologies, including the direct use of electricity (e.g., electric arc furnaces for steel production). How expensive it is to produce and use low-carbon hydrogen will be the key factor shaping its competitiveness, and the sectors which use it for decarbonisation. The average lifetime cost of producing green hydrogen (the “levelised cost”) is driven mainly by electricity prices (the input fuel), electrolyser costs (which are expected to drastically fall by 2030), and the cost of financing projects. For blue hydrogen, the levelised cost will be driven by natural gas prices and the cost carbon capture and storage facilities, both of which are highly uncertain.

The UK isn’t the only country providing financial support for hydrogen production to help lower the levelised cost. Through the Inflation Reduction Act, the US is providing a Clean Hydrogen Production tax credit worth up to US$3 per kilogram of hydrogen, while the European Union awarded nearly €720m in fixed subsidy support through the European Hydrogen Bank. Many other countries, including Chile, India and Australia, are pushing forward with their own hydrogen subsidy schemes but have been unable to match the scale of the US and EU’s financial support.

Depending on how far and fast costs fall, hydrogen could grow to play a substantial role in the UK’s future energy system. The Climate Change Committee estimates that the UK’s demand for low-carbon hydrogen in 2050 could reach up to 376 TWh, more than current electricity demand of ~300 TWh. Developing a “hydrogen economy” in the UK could provide wider benefits beyond just emissions reductions, with the Government estimating that the sector could be worth £900m and support 12,000 jobs by 2030, rising to up to £13bn and 100,000 jobs by 2050.

Despite fierce debates over the suitability of hydrogen as a low-carbon technology, governments are pushing forward with regulations and policy support driven by the potential economic value of capturing the hydrogen value chain. Around the world, 41 governments now have a hydrogen strategy in place, up from just 15 when the UK published its own Hydrogen Strategy in 2021. Through schemes such as the NZHF, the UK Government is aiming become a world leader in producing and using low-carbon hydrogen. The next decade will show whether the UK is well-placed enough to deliver on that ambition.

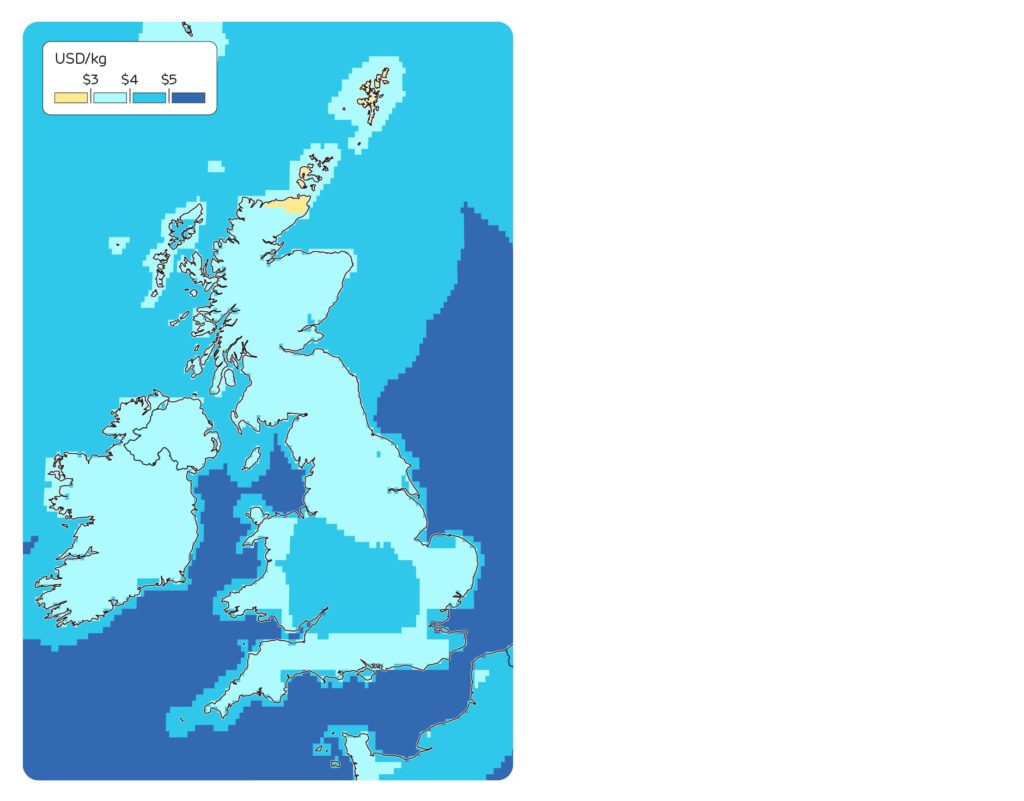

The levelised cost of green hydrogen produced from onshore and offshore wind across the British Isles. Data from Bamisile et al., 2023.