Introduction

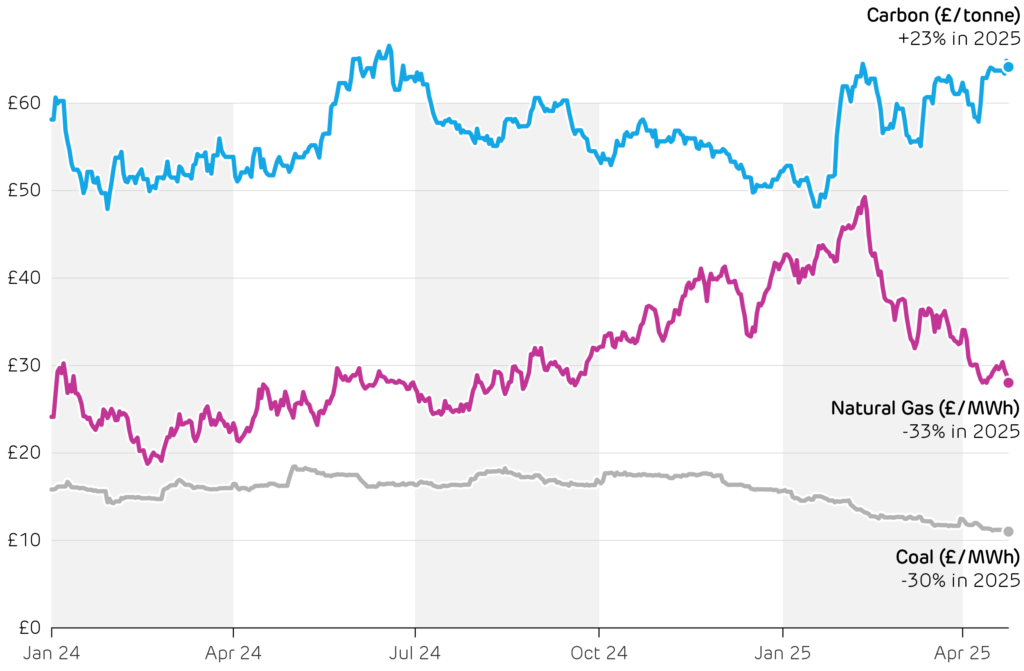

2025 got off to a turbulent start. Spain and Portugal suffered Europe’s largest blackout in over a decade, sparking considerable debate over the causes and solutions. The US imposed, then partially revoked, tariffs on all countries. Stock markets and oil prices slumped over fears of a global recession and reduced trade. Natural gas prices in the UK have fallen by a third since the start of the year, from £42 to £28 per MWh, bringing relief to both household and industry energy bills. This contributes to the large fall expected in Ofgem’s energy price cap from July onwards.

In contrast, the UK’s carbon price has increased by a quarter over the same period, from £52 to £64 per tonne of CO2. Nearly 20% fewer permits are being issued this year to align the market with the Government’s stricter netzero cap. At the same time, investors are rushing to buy permits over speculation that the UK and higher-priced EU emissions trading schemes will be linked.

Ofgem announced major reforms to grid connections, in an effort to unblock new investment in clean electricity generation. Article 2 discusses how this can help plug the shortfall in meeting the Government’s Clean Power 2030 targets. Investment in new solar PV capacity continued to gather pace, in part because planning laws around new utility-scale solar farms were relaxed. Combined with a particularly sunny start to spring, this means solar output is smashing records, so far it is 40% higher than just a year ago. This raises concerns about how far net demand will fall during sunny afternoons later in the Summer, discussed in Article 3.

Alongside solar PV, electric vehicles (EVs) and heat pumps are also taking off. The UK became Europe’s largest market for EVs in 2024, topping German sales for the first time. Article 4 looks at the impacts this will have on electricity demand going forwards, in particular increasing peak demand. Finally, hydrogen has been touted for decades as an alternative to electricity for powering our vehicles and heating our homes. We look at areas where hydrogen’s progress is stuck in the starting blocks, and where it could make a material difference to the UK’s decarbonisation.

Wholesale fuel and carbon prices since the start of 2024.