Headlines

Dr Iain Staffell, Professor Richard Green, Professor Tim Green, Professor Rob Gross and Dr Malte Jansen -Imperial College London

There was little to celebrate in 2020, but at least clean energy offered a source of good news.

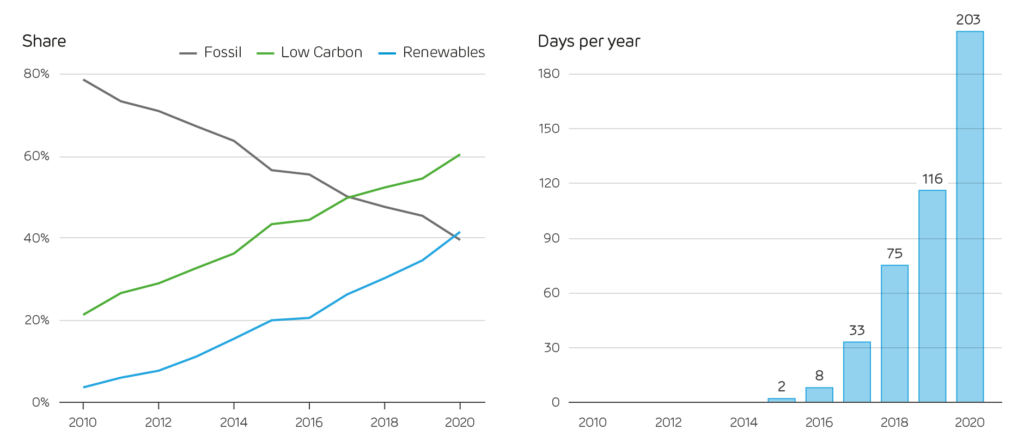

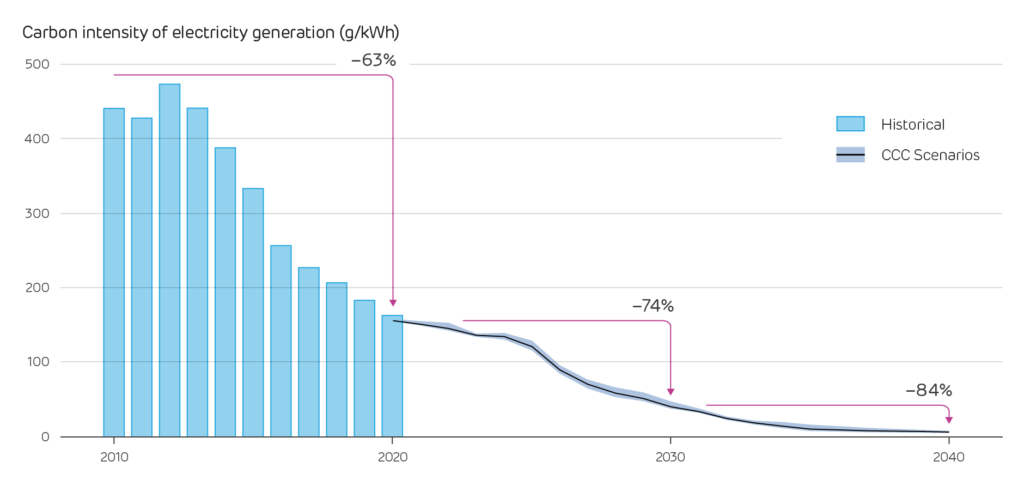

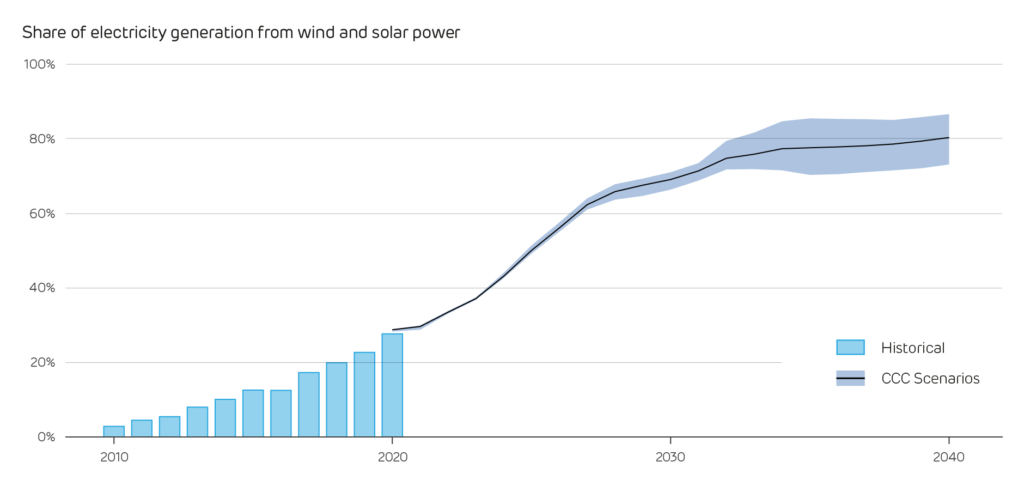

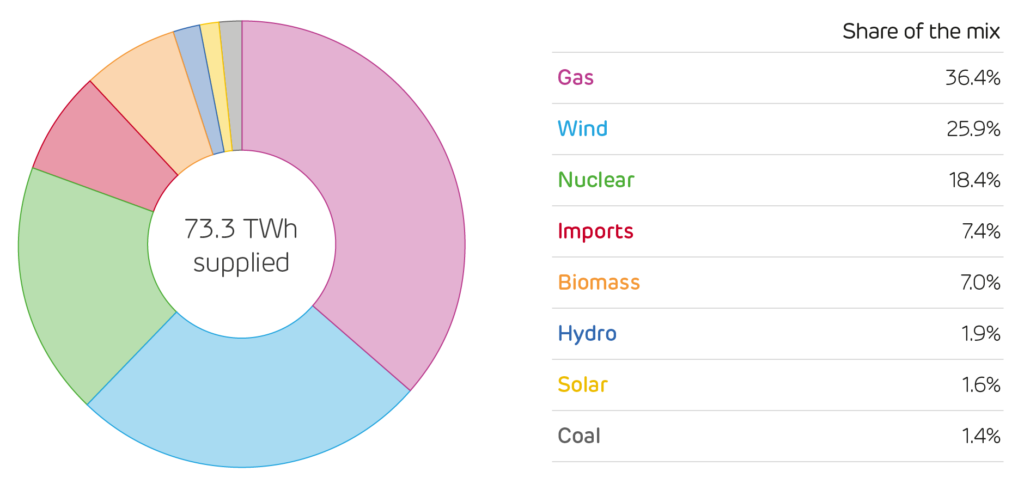

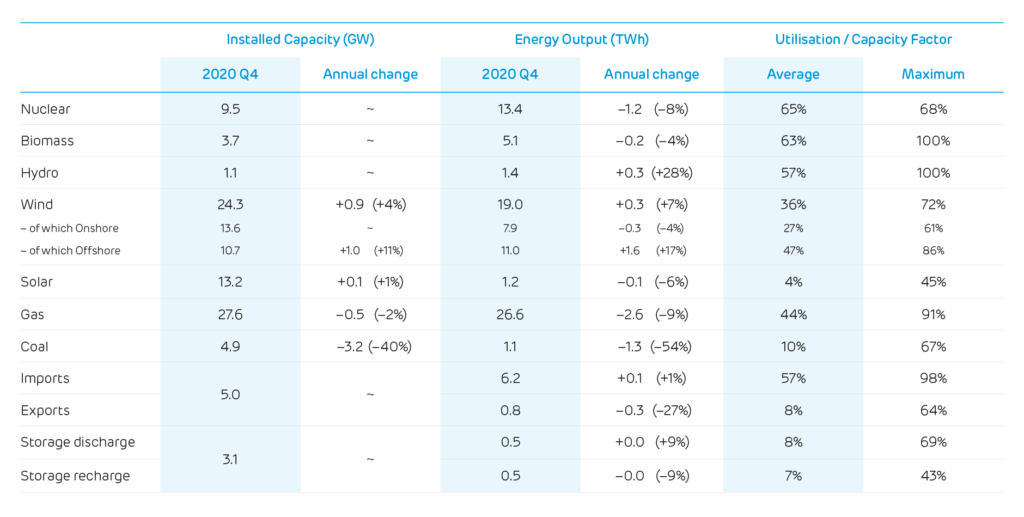

In a major milestone, more of Britain’s electricity came from renewable energy sources than from fossil fuels over the last year. Renewable generation increased by a sixth on 2019, to supply over 100 TWh of clean electricity. Carbon emissions from electricity generation were also down a sixth.

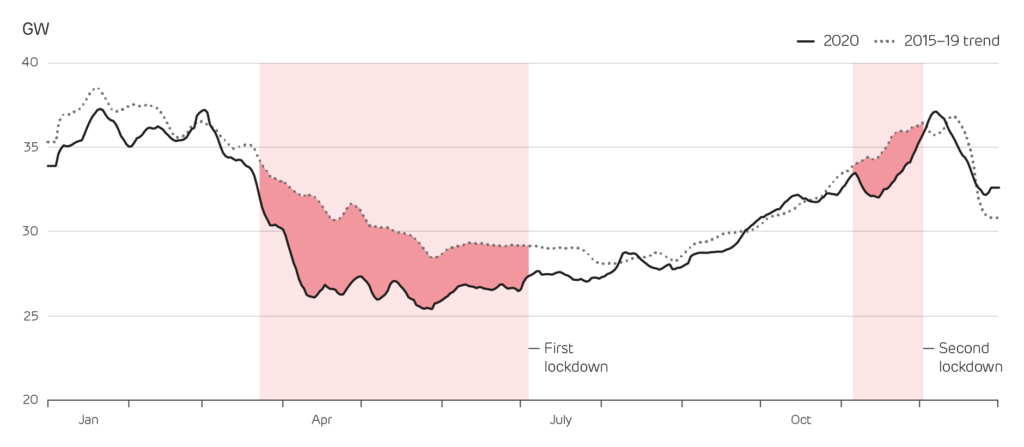

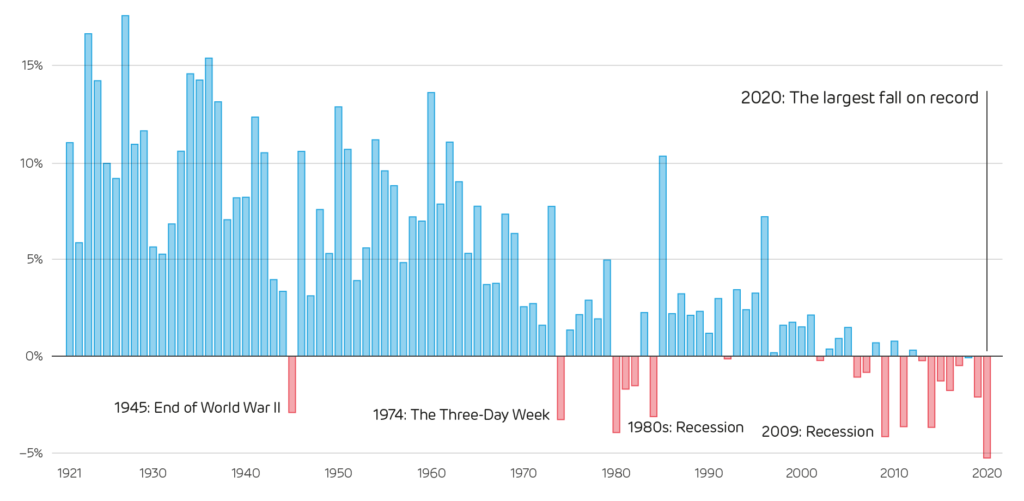

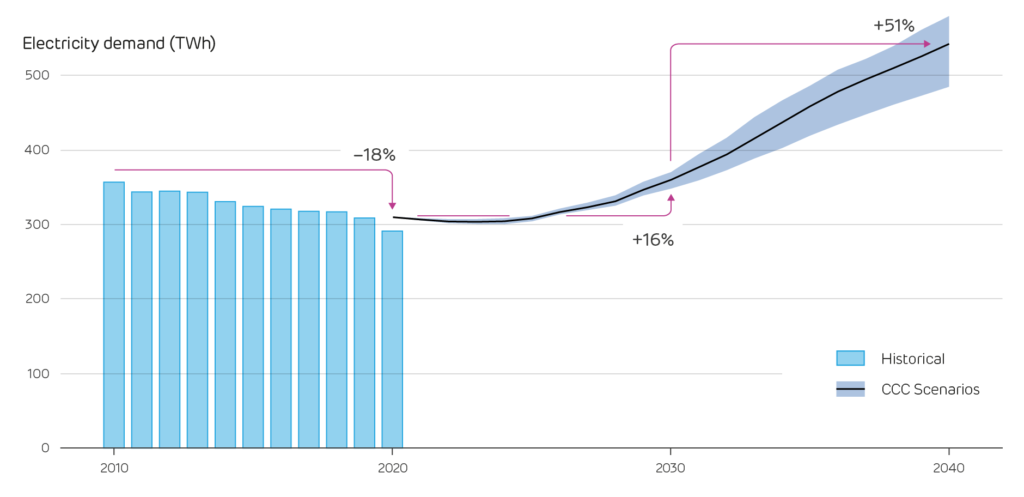

2020 was a record-breaking year for the power system, in many ways because of the coronavirus pandemic. Lockdowns reduced activity, so electricity demand fell by 6%, the largest ever recorded in the national grid’s 100 year history. Fossil fuels took the brunt of this fall, and their generation fell below 100 TWh for the first time since 1960.

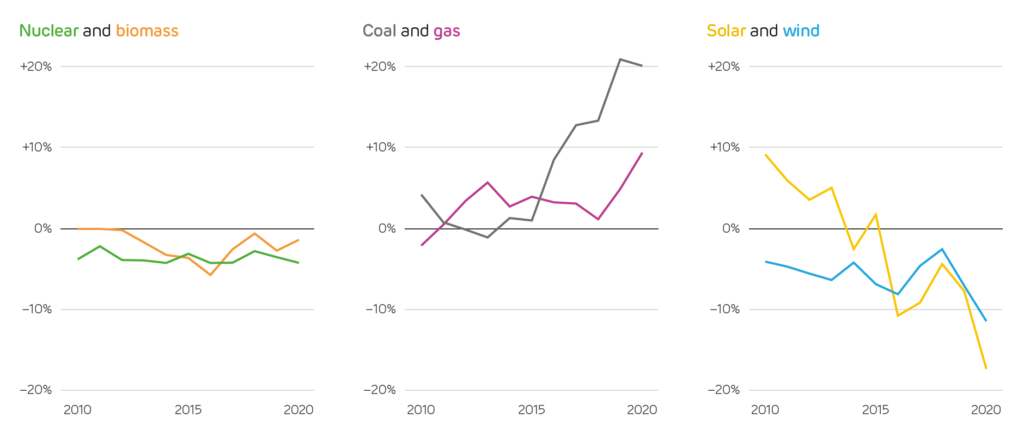

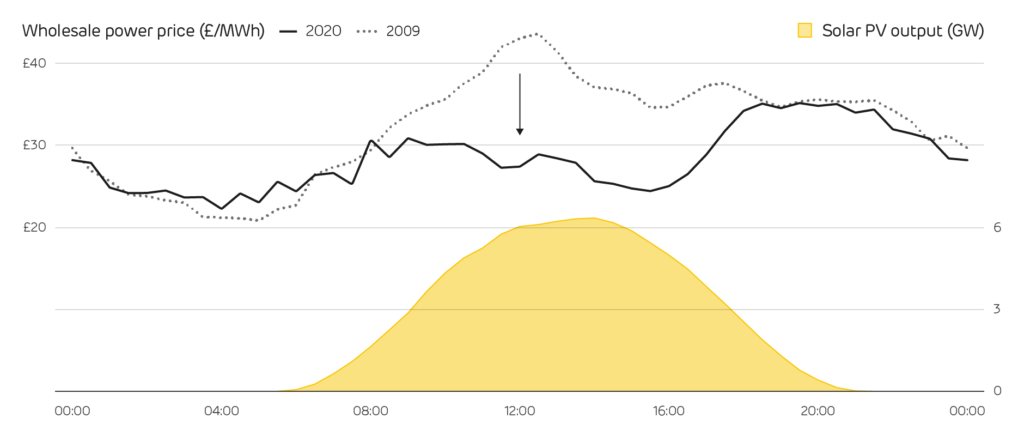

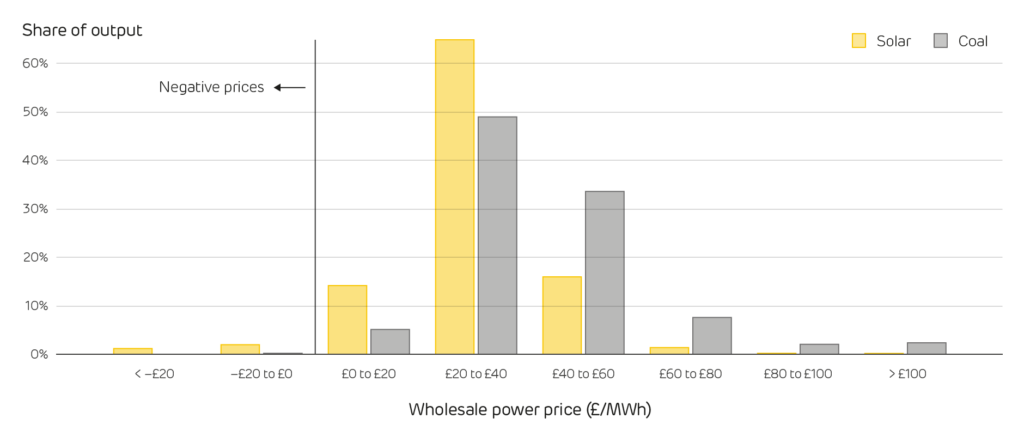

Suppressed demand contributed to electricity prices falling to their lowest in 15 years. The increased share of renewables also meant they were more volatile, which means the relative value of technologies is changing. Fossil-fuelled power stations earned 25% more per unit of output than wind and solar farms over 2020, highlighting the premium that flexible and controllable technologies can command.

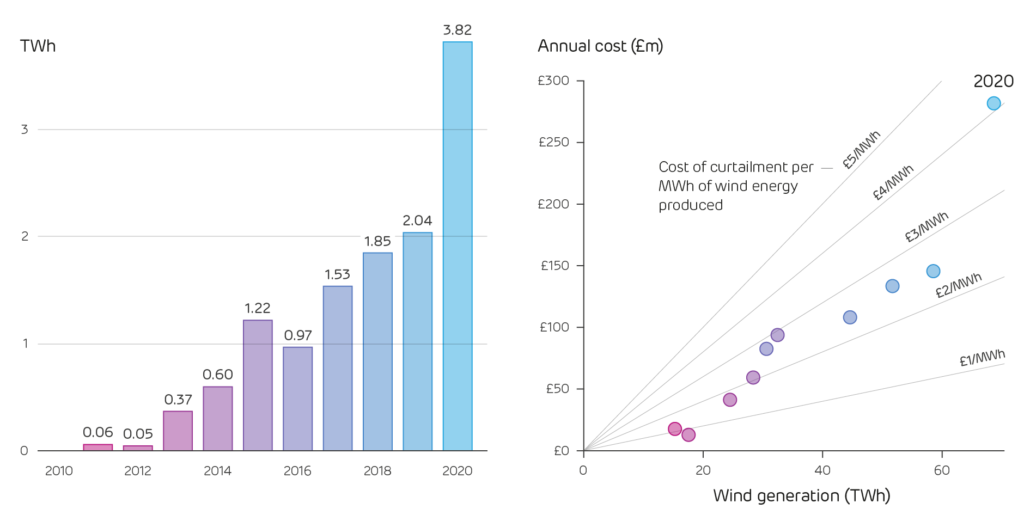

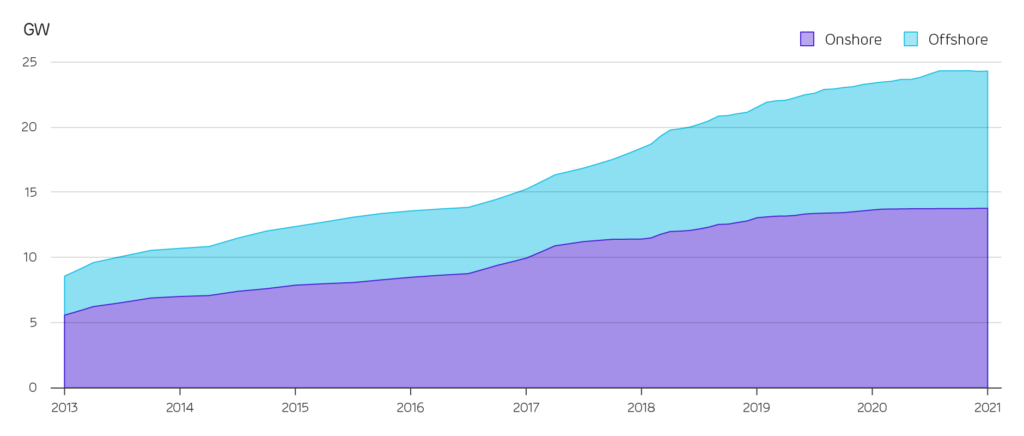

Wind power was a big winner, shattering several records in 2020. In December wind output hit an instantaneous peak of over 17.4 GW, and across the whole year it produced a quarter of Britain’s electricity. While output was up, so also was the amount of curtailment – wind energy that had to be dumped because of constraints on the transmission network. Curtailment doubled in 2020, at a cost of over quarter of a billion pounds.

Christmas Day was very different for many of us. Restrictions on movement meant people had to stay home rather than seeing family, and more people cooking individual dinners helped to push peak demand to its highest level for a Christmas Day since 2010. There were no lumps of coal from Santa Claus though, as it was the first ever coal-free December 25th since the electricity age began in the 1880s. Boxing Day then saw a slew of clean-energy records, with over half of the day’s electricity coming from wind power, and 80% from all low-carbon sources.