Will planning reform help the UK meet its clean power targets?

UK is being held back by its creaking planning system. Examples are abundant, from spectacular delays and cost overruns of HS2 to the nationwide shortfall of 4 million homes. The power sector faces similar challenges. New projects are waiting more than 10 years for a grid connection, which threatens to derail our energy transition. Britain has made strong progress on decarbonisation, generating more than 65% of electricity from clean sources in 2024. However, fears are growing that the Government’s target of 95% clean power by 2030 is unachievable without reforms to expedite grid access.

Mind the gap

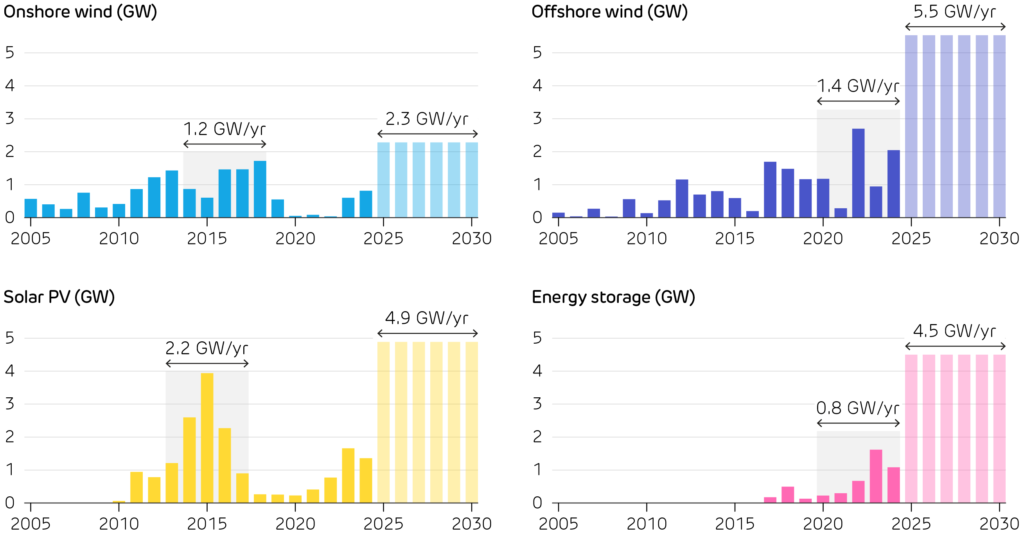

Britain’s wind, solar and storage capacity must all more than double in just the next five years to meet the Government’s Clean Power 2030 targets. This makes it essential that projects are built and connected to the grid at a faster rate than has been seen at any point during the last two decades. Last July, Ember warned that the target for 50 GW of offshore wind was “out of reach”. The gap has narrowed since a larger budget was allocated to the sixth round of CfD auctions, driving more renewables uptake. However, Cornwall Insight recently projected that while existing plans would deliver 83 GW of wind and solar capacity, this is still 32 GW short of the Government’s minimum target.

Connection queue crisis

The connection queue is the list of projects with signed agreements to be plugged into the grid, but are not yet built. A project’s position in this queue dictates when it can start selling power. The previous “first-come, first-serve” rules meant developers could lock in grid connections at low cost for speculative projects with no firm plans to progress – akin to a holidaymaker claiming the hotel sunbeds with their towel at 6 am, only to then snooze in their room all day. The queue is now occupied by hundreds of “zombie” projects which delay connections for shovelready projects. By February 2025, the queue contained projects totalling 765 GW, enough to match Britain’s average electricity demand 25 times over.

Historical build rates for wind, solar, and energy storage projects in Britain, and the average rates needed over the next five years. For each technology, the five-year window with the highest build rate is highlighted, and these rates must triple on average to meet the Clean Power 2030 targets.

Ofgem’s Reform package

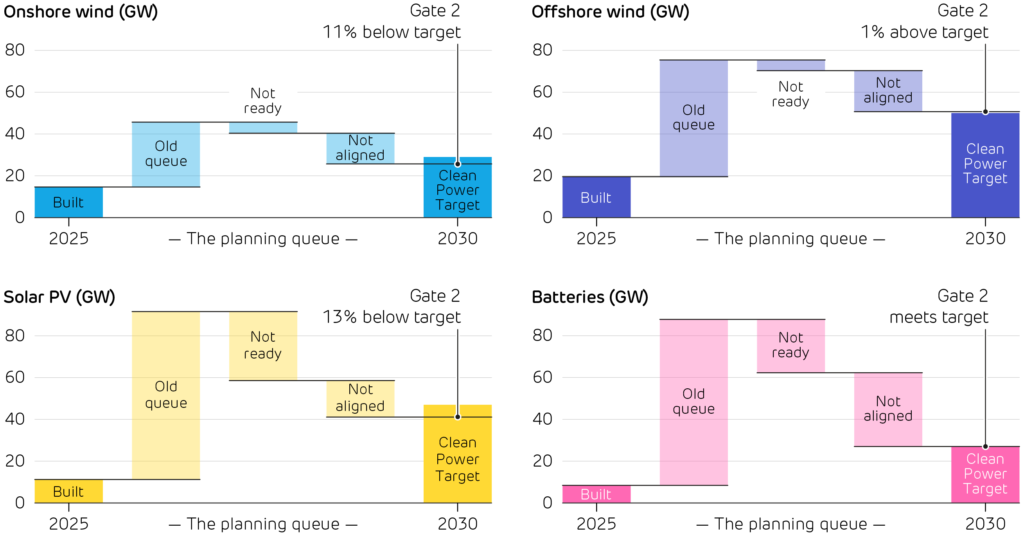

The Planning and Infrastructure Bill introduced in March promises to cut average waits by up to 7 years by switching to the “first-ready, first-connect” principle. Ofgem’s Connections Reform Package from April enacts these rules, creating two ‘Gates’ within the queue. Gate 2 provides firm dates to schemes that are both ready to connect (with finance, planning consent and land rights) and aligned with the 2030 Clean Power capacity requirements. Gate 1 instead offers indicative dates for projects that are either not ready or not strategically aligned.

More than half of the 765 GW queue may be downgraded to Gate 1, however, Gate 2 alone will not be enough. If all Gate 2 projects could be delivered by 2030, offshore wind and battery storage capacity would reach their targets, but onshore wind and solar PV would fall more than 10% short

Will it be enough?

It is too early to say whether these reforms will unlock the required investment. Detailed network modelling is still in progress, but early analysis from Ofgem shows the potential for undersupply of both solar and onshore wind, even if all projects in the Gate 2 queue are operating by 2030. Still, Ofgem estimates this package will save around £5 billion (£200 per household) on reinforcing the grid by prioritising projects that are in the parts of the country most in need of new supply.

Even with these reforms, meeting our 2030 targets will be a profound challenge. Uncertainty over the future structure of the electricity market following REMA, alongside fears of recession mean that developers are struggling to finance projects. Issues around local consent and supply-chain pressures present further barriers to build-out. Developers need clarity around market reform, supply-chain support, and further policies to lessen the burden of local consent. All eyes will be on next summer’s results from the seventh round of CfD auctions – an important indicator of the success of reforms – as they will determine what additional support will be required to stay on track with decarbonising the power system.

The impact of Ofgem’s reforms on the connection queues for solar, wind and battery storage, and how the remaining ‘Gate 2’ pipelines stack up against the Government’s 2030 targets. ’Built’ includes projects under construction, and only transmission-connected projects (rooftop solar is excluded).