Q2 2022: Do renewables deliver value for money?

Download PDF

Dr Iain Staffell, Professor Richard Green, Professor Tim Green and Dr Malte Jansen – Imperial College London

The government has launched a Review of Electricity Market Arrangements (REMA), covering practically every aspect of wholesale electricity trading. This is only the second such review since the industry was privatised in 1990. A review in 1997 replaced centralised dispatch with the current system of independent power exchanges and bilateral trading. Then the Energy Act of 2013 added contracts for differences (CfDs) to support low-carbon technologies and the capacity market to support ‘firm’ generators that help with security of supply. Will the current review lead to a similarly big shake up?

Under the current British Electricity Trading and Transmission Arrangements (BETTA), the National Grid is charged with keeping the power system stable, balancing the system in real time, buying and dispatching reserve capacity, adjusting generation (and occasionally demand) to keep power flows within the limits on transmission lines, and procuring various other ancillary services. As the proportion of renewable generation grows, it becomes harder to manage the power system, and the cost of providing these services will grow. This makes a thorough review worthwhile. The options range from “very little change” to some quite radical proposals, a few of which seem to be untested anywhere else in the world (though, of course, someone has to be first).

Most attention has gone to the suggestion that the market must change so that nuclear and renewable generators (with very low marginal costs) no longer receive the market price set by gas-fired generators (with much higher marginal costs). This is not a new complaint. One motivation for the first review back in 1997 was the claim that it was wrong for gas-fired generators to be able to undercut more expensive coal stations when bidding into the centralised market, but still receive the same System Marginal Price.

However, that review’s change to bilateral trading at mutually agreed prices did not put a stop to this. In a free market, companies naturally want to get ‘the going rate’ for their product. While there was nothing in the rules that said a nuclear station will automatically receive the same price as all other stations running at the same time, that is what the traders selling their output managed to achieve. Ultimately, nuclear, gas, wind and any other types of power station sell the same product: electricity; so it attracts the same price.

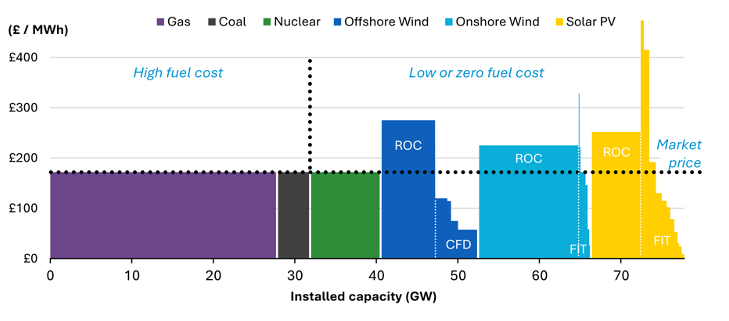

That said, it is wrong to think that all low-carbon generators are receiving the current (and very high) market prices for their electricity. The present system already pays newer power stations less because they sell their electricity through Contract for Differences (CfD). These initially provided high prices, as the first new-build nuclear reactors and offshore wind farms were expensive to build. Hinkley Point C and the East Anglia wind farm were both awarded over £100/MWh in today’s money, which was expensive compared to fossil fuels at the time. But even these earliest contracts are now well below the average wholesale price of electricity. The newest offshore wind farms have been contracted for less than £40/MWh, so once operational they would be giving three- quarters of their revenue back to the government at current prices. Now that market prices are higher than their strike prices, those contracts pay money from the generators back to the government-sponsored Low Carbon Contracts Company, which distributes the rebates to retailers. The retail price cap takes this into account, so that households are paying less for renewable energy from newer stations.

The average revenue received by each technology in the wholesale market during H1 of 2022. Wind and solar capacity are split by support type, and vary based on installation size and date (as tariffs were reduced in line with technology costs).

Some small generators, such as rooftop solar PV, were supported with feed-in tariffs and so also receive fixed prices. However, older renewables that pre-date CfDs were given Renewables Obligation Certificates (ROCs) as a second revenue stream on top of selling in the wholesale market, and the existing nuclear fleet also sell at wholesale prices. This does not necessarily mean that the plant owners are the ones profiting from the high gas prices. Generators tend to sell much of their expected output in multi-year fixed price contracts, to give some revenue stability. This means the windfall profit goes to the company that bought the contract, and as these can be resold indefinitely, the true home of the windfall profits difficult to uncover.

How could the government make sure these generators get a lower price? Professor Rob Gross and researchers at the UK Energy Research Centre suggested in April that the government could auction CfDs to existing generators are a quick way to reduce ‘overpayment’. Some may find it attractive to swap a risky future with unknown market prices for a stable price, even one that was lower than current wholesale prices. Generators did sign up for equivalent contracts during the Californian Energy Crisis of 2000-01 (which saw power prices rise 800%), helping to end the crisis. Although nuclear and renewable generators are cheap to run, they cost a lot to build. Older stations should have paid back that cost years ago, but newer stations won’t be able to if the prices they can charge are held too low. One option in the consultation paper combines a rule forcing generators to bid their variable costs into an auction (used in some markets around the world) with an auction rule that pays winning bidders their own bid. That rule is also used in a wide variety of auctions, but never in combination with the first one – as together they would guarantee that stations could never recover their fixed costs. Such interventions could deter future investors and derail the longer-term transition away from fossil fuels, so care must be taken in any market redesign.