Q2 2023: UK carbon prices sink

Download PDF

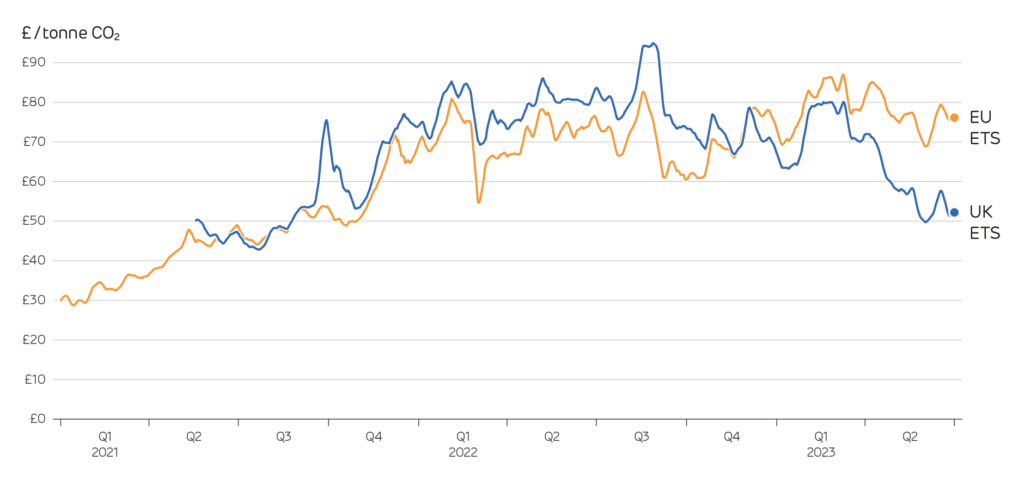

The UK’s carbon price has plunged by 40% in recent months, and it now trades at its biggest ever discount to Europe. This means it now costs less for power stations and large industries to burn coal, gas and oil. While this provides some respite to high energy prices, it poses a risk to the UK’s net zero ambitions.

For sixteen years, the UK was part of the EU Emissions Trading System, but had to leave after Brexit and set up its own UK ETS. In both schemes, fossil-fuelled power stations and other large sources of carbon dioxide must surrender one permit for every tonne of CO2 they emit. Generators have to buy all their permits, but industrial companies get many of their permits for free to help them stay competitive internationally. Since any unused permits can be sold to other companies, the scheme gives an ‘opportunity cost’ to emitting CO2 equal to the permit price per tonne.

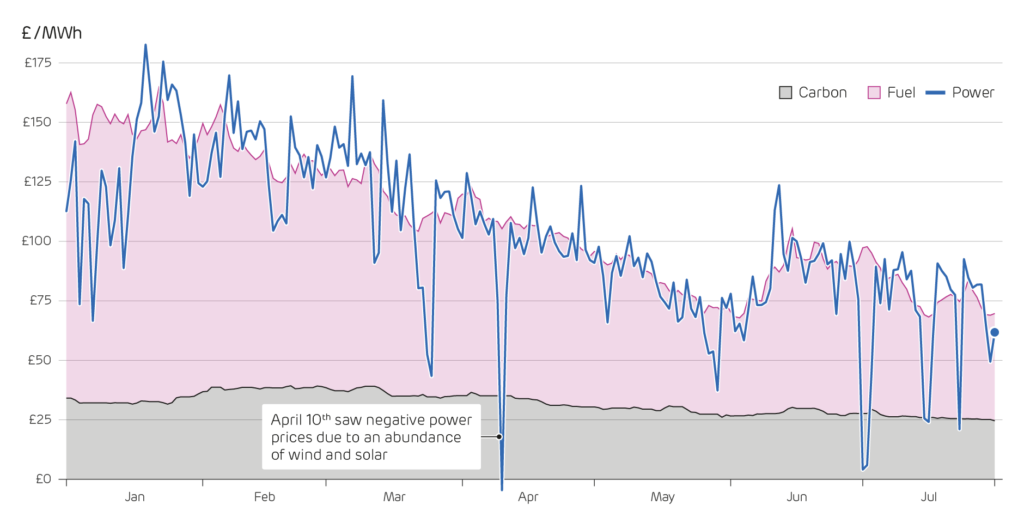

This can be seen in the way that British electricity prices follow the combined price of gas (adjusted for power station efficiency) and cost of CO2 emitted, which is the price of permits plus the carbon price support (a tax set at £18/tonne since 2015).

For an electricity system with a mix of fossil-fuelled power stations, the easiest way to reduce emissions towards a target is to burn less (high-carbon) coal and more (lower-carbon) gas, and the price of an emissions permit should settle at the level where just enough coal-powered stations become uncompetitive against their gas-burning competitors. If the price of gas rises, the price of permits needs to increase to discourage coal burning, whereas if the price of coal rises, the price of permits can fall.

Britain now burns so little coal (0.2% of production last quarter) that this mechanism cannot work directly. If emissions are too high, reductions must come either from reducing the absolute amount of fossil-fuelled electricity generation (which implies adding renewable capacity, increasing imports or reducing electricity demand) or from industrial emitters such as iron or cement plants. The price of permits should therefore reflect the cost (per tonne of emissions avoided) of these actions, and specifically the most expensive actions needed to meet the target.

There’s a degree of slack in the system, as permits can be “banked” until the following year if emissions are lower than expected in a given year (e.g. due to a mild winter). Also, as 2024 permits will be issued shortly before those for 2023 must be surrendered, it is possible to “borrow” from the future in the event of a (temporary) increase above the number of permits available in 2023.

In practice, fewer permits have been needed than were made available, adding to the slack in the system. This means that permit prices largely depend on expectations of how much action will be needed to meet future emissions targets, and what those actions will cost. The tougher a scheme’s target for reducing emissions, the higher its price is likely to be. There have also been suggestions that the UK scheme will be linked to the (much larger) EU ETS, allowing British emissions to be offset by EU certificates and vice versa. This ought to give the two schemes the same price; if people believe that they might do so in future, this should drive their prices closer together than if there was no prospect of that happening. From the market’s creation until March 2023, the UK ETS remained within ±15% of the EU ETS price for 90% of the time. Prices in the EU are set by the same underlying forces as in the UK, but coal-gas switching is still relevant, and the emissions targets are different compared to “business as usual” levels.

Prices in the UK ETS, which were 7% below those in Europe as recently as March, have now fallen to 30% below. The UK government has announced that it will increase the emissions that will be allowed between 2024 and 2027, compared to earlier expectations. Overall, the allowed emissions from 2021 to 2030 are described as “at the top of the net zero consistent range”, in part because the “new” certificates are ones that the government had allowed itself to issue in the scheme’s first years, but had not been sold due to lack of demand for them. Nevertheless, the announcement has been seen as loosening the commitment to reduce emissions, and prices have fallen.

What will this imply for the electricity sector? The last coal-fired station is about to close anyway, so we can’t see much gas to coal switching, but the lower marginal cost of gas-fired stations will slightly reduce electricity prices. A £10/tonne reduction in the price of carbon dioxide would, if passed on, lead to electricity prices falling between £3 and £4/MWh at the frequent times when gas-fired stations are at the price-setting margin.

Lower electricity prices in Great Britain will make it less attractive to export power to us, implying that our generation will sometimes have to rise to replace imports, or even export power to the continent. UK emissions would rise when this happens, but emissions in Europe would fall; they don’t count in the UK’s official statistics, but the planet notices them. Renewable generators that are already installed will run whenever they can, but a lower price makes it slightly less attractive to build new ones.

The decision is perhaps more important as a signal (alongside some others sent recently) about the level of government commitment to bearing the costs of decarbonisation. Some of those costs turn into financial benefits – electric vehicles typically cost less than petrol ones over their lifetime, and energy bills (or government subsidies on them) would have been lower last winter if energy efficiency policies hadn’t been cut back after 2012. But the up-front costs of many low-carbon measures should not be ignored, and political support for continued action will depend on helping people to meet them.