Q3 2020: The Saudi Arabia of wind power?

Download PDF

by Phil McNally, Energy UK

On October 6th, the Prime Minister reaffirmed strong commitments to offshore wind.

While this could cement the UK’s world leading position, it alone does not make us “the Saudi Arabia of wind power” as was widely reported.

There were four key takeaways from the PM’s speech:

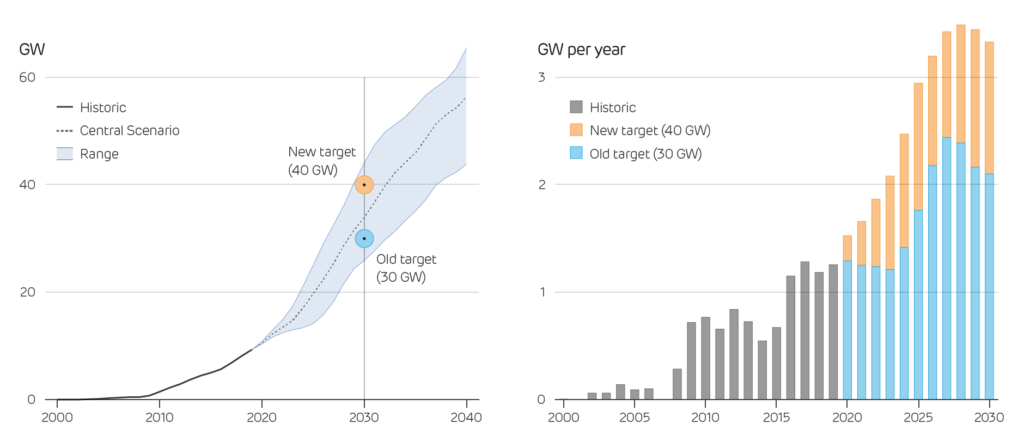

- Boosting the Government’s previous target from 30 GW to 40 GW of offshore wind by 2030

- Creating a new target for floating offshore wind to deliver 1GW by 2030

- Making £160 million available to upgrade ports and infrastructure

- Supporting up to double the capacity of renewable energy in the next Contracts for Difference (CfD) round

There’s a mix of new and existing information in there. The 40 GW target was part of the 2019 Conservative election manifesto, and industry has been working towards the target for a while. Regardless, reaffirmation from the top is welcomed. The new target is pushing close to the upper bound of National Grid’s most ambitious scenario for deployment, and requires us to install three times more capacity per year throughout the 2020s than was achieved in the 2010s.

The rest is new information. The 1 GW target for floating offshore wind is the first sign of a clear ambition from government on this burgeoning technology and has been welcomed by industry. Floating wind turbines could significantly expand the UK’s offshore wind generation, with the IEA estimating that more than half of the UK’s offshore wind resource exists at depths of more than 120 metres, and a fifth at depths more than 800 metres.

The £160m for upgrading local infrastructure is key to scaling up the offshore wind industry allowing larger turbines to be constructed and deployed at a faster rate. The final announcement has the potential to align UK renewables deployment with a net zero consistent pathway for the first time, but we await further clarity.

So, what could 40 GW of offshore wind actually do for the UK? Newer turbines will sport larger blades and taller towers, and so will offer higher capacity factors than today’s machines. BEIS assume a capacity factor of 47% for new offshore wind farmsbeing built today, up from 40% historically.[1] This could potentially rise to 57% for new turbines built in 2030, if improvements in blade diameter, hub height, turbine design and siting are all realised.

This would mean that by 2030, the UK’s 40 GW of offshore wind would have an average capacity factor of 49%, and could produce 170 terrawatt-hours (TWh) of electricity per year. That is equal to three-fifths of Britain’s total electricity demand, and is easily enough to make good of the PM’s claim to have “every household in the UK powered by offshore wind”. By 2030, the nation’s 26+ million households are expected to consume in the region of 100-120 TWh per year, including new demands from electric heating and vehicle charging.

But, is that really enough to make us the ‘Saudi Arabia of wind’? Not by itself. Saudi oil fields produce around 10 million barrels a day, or around a tenth of the world’s oil demand. This translates to 6,000 TWh per year, meaning it takes just ten days to produce 170 TWh.

If the UK wanted comparable energy dominance to Saudi Arabia it would need to build over 1400 GW of offshore wind. While that is a massive leap from current plans, it lies within the theoretical potential of the UK’s 300,000 square miles of waters. The IEA report that the best sites could hold up to 1900 GW of capacity, giving a technical potential of 9000 TWh per year – enough to power the EU three times over.

The UK has favourable circumstances for offshore wind deployment – with shallow waters, high wind speeds and significant deep offshore infrastructure expertise. While exploiting the whole of this resource is of course a long way off, it must be remembered that Saudi Arabia had a century of oil field development to get to where it is today, whereas the UK’s offshore wind industry only took off ten years ago. Where it could be in another 90 years leaves ample room for imagination.

[1] The average capacity factor for British offshore wind farms experienced over the past five years.