The UK’s carbon price surges

The UK’s carbon market, which sets the cost of emitting CO2, is experiencing a strong rally this year. The carbon price is up 75% since January, pushing up the cost of generating electricity from fossil fuels.

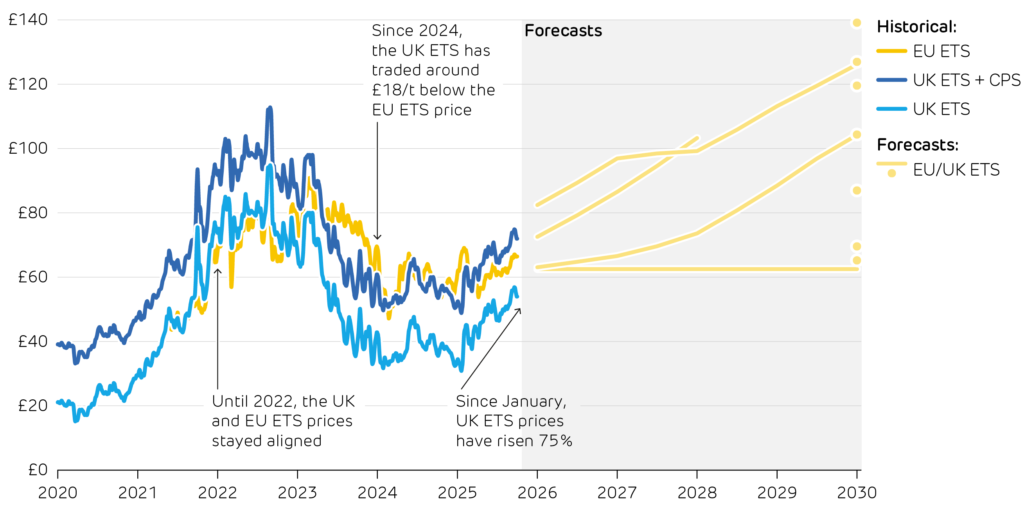

For two decades, the European Union’s Emissions Trading Scheme (ETS) has placed a price on emitting carbon, giving companies the incentive to reduce emissions. The UK has run its own carbon market since 2021, separating from the European ETS as part of the Brexit negotiations. Through 2022, UK prices stayed aligned with the much larger European market, as their designs and the strictness of their targets were similar.

UK carbon prices tumbled in 2023, at one point falling to less than half of European prices. The UK’s ETS Authority issued more allowances to emit carbon, just as a faltering economy meant actual emissions were lower than anticipated. From 2024, the UK’s price settled around £18 per tonne lower than Europe’s price. £18 is a special number: it is how much the UK charges in addition to the ETS price for carbon emissions from major power stations.

This £18 ‘Carbon Price Support’ was instrumental in kick-starting the UK’s rapid decarbonisation of electricity a decade ago, making coal power more expensive than gas, and making low-carbon alternatives more economically viable. It had a downside though, putting British power stations at a disadvantage against imported electricity. In the first half of 2021, a British gas-fired power station paid £65 for each tonne of CO2 emitted, but one in Belgium or the Netherlands paid only €44 (£38). In the first half of 2025 this has equalised, with £62 paid in Britain versus €73 (£61) on the continent.

Carbon prices in the UK and Europe, converted to £/tonne. Forecasted prices from OBR, Reuters, BloombergNEF, Enerdata, and Simon Kucher.

At the end of January this year, the FT reported that talks had begun to rejoin the UK to the EU ETS. The UK carbon price jumped by 13% in a single day. At the UK-EU Reset Summit, both sides committed to take this forwards. Once linked, UK carbon prices would reconverge with those in the EU.

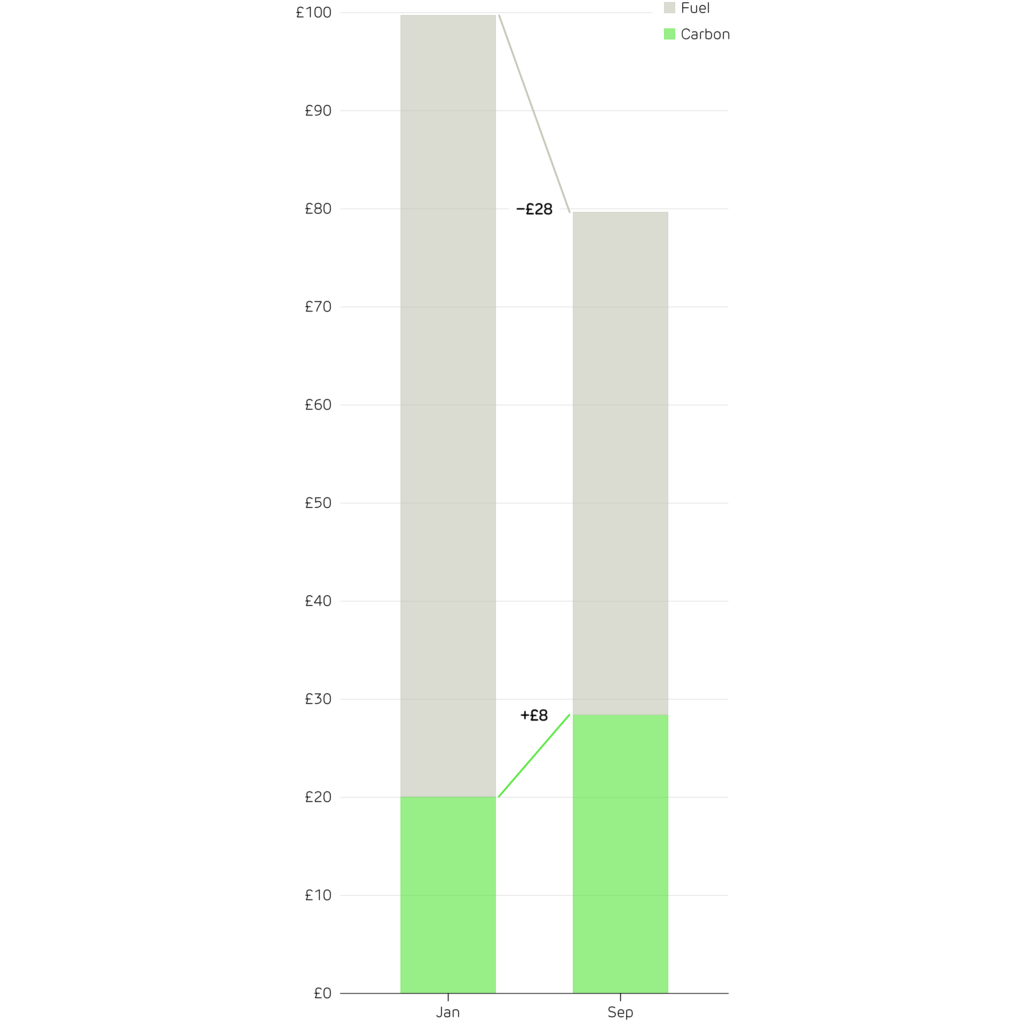

The upshot is that prices have risen by 75% since the start of this year. As every 2.5 MWh of electricity produced from gas power stations produces 1 tonne of CO2, this is putting upwards pressure on power prices. The rise has been modest though, adding £8/MWh over the last nine months, and has been more than offset by the fall in wholesale gas prices.

Even if European carbon prices stand still, relinking the markets would see UK carbon prices rise by a further 25%. It will reduce red tape though, as British businesses will avoid having to pay Europe’s new Carbon Border Adjustment Mechanism (CBAM), which comes into force next year. This will see Europe charge its ETS price on all carbon-intensive imports to the bloc, such as iron and steel, aluminium, fertilisers, and of course, electricity. The link may also add some certainty for businesses, making investments into cross-border projects such as interconnectors look more secure.

Looking forwards, projections for the ETS price point in one direction: up. Analysts see carbon emissions costing anywhere from £60 to £140 per tonne in 2030, as political will to decarbonise ratchets up, and free permits granted to some heavier industries are phased out. This will add further to the cost of generating electricity from gas, but with Government aiming to greatly reduce its share by then, this should have a weaker impact on the prices we pay for electricity.

Changes to the cost of generating electricity from a gas-fired power station in Britain (in £/MWh), between January and September of 2025.